Extra-EU export in practice

- Sandra Visser-Meijer

- How to

- Edited 4 November 2025

- 7 min

- Managing and growing

- International

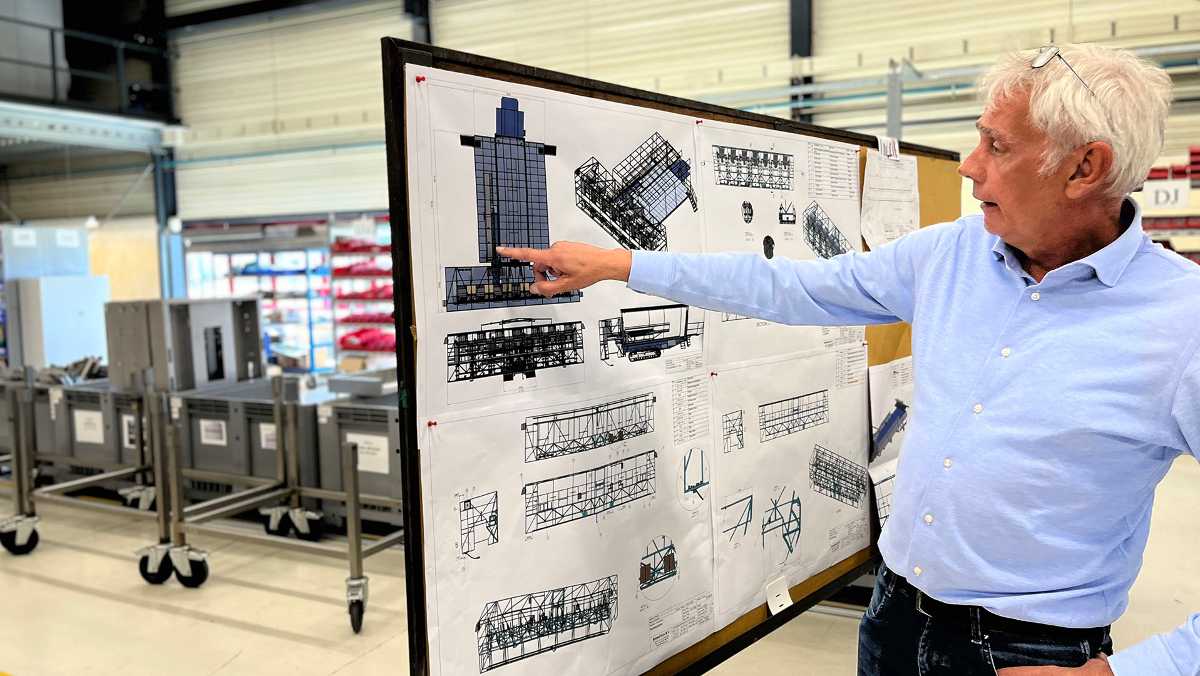

Ron van de Pavert first took his company, H.J. van de Pavert BV, to Germany in 2003, and the owner of Ulft-based BrimaPack now sells his machines to customers all over the world. Van de Pavert decided to outsource export declarations to a customs broker, who also helps him draw up export documents. His advice: “Preparation is key: make sure that you know exactly which requirements you have to meet to avoid problems further down the road.”

To sell goods to countries outside the EU, you have to declare them to customs in both the exporting and importing country. It is uncommon for suppliers to file a customs declaration in the importing country, as this will usually be done by the importer. The Incoterm® DDP is the only exception. Product requirements may also differ from one country to the next. Van de Pavert explains how his company machinery to countries outside the EU. The following topics are covered:

- Market research

- Market approach

- Arranging transportation

- Export documents

- Customs and taxes

- Set your export price

- Record your agreements

- Getting paid

Market research

develops and produces packaging and sorting machines for vegetables such as broccoli and iceberg lettuce. The company serves customers all over the world, which means it needs a lot of highly specific local knowledge.

Van de Pavert prefers leveraging his network to conduct market research, relying on fellow businesses and industry peers like seed growers and suppliers. Since he founded BrimaPack in 2006, he has managed to build an extensive international network. “In our industry, we communicate openly about products, prices, suppliers, and customers. A 15-minute conversation is all I need to find out what I need to know about 80% of the main buyers in a new export market.”

Opportunities

When he goes abroad, Van de Pavert always makes sure to visit a supermarket to check whether there is a demand for his products. “Growers often put their label on the vegetables they produce, which is a handy way to unearth the bigger growers.” He also monitors the moves made by large supermarket chains. “These companies want their vegetables packaged in a European way, which means sealing them in plastic to extend their shelf life. Our machines can help them do just that.”

Local product requirements

Machinery, like many other industrial product groups, must comply with CE that are mandatory in the EU or EEA. Countries outside the EU sometimes require different standards. For example, since Brexit, the UK has had a mark.

“The rules differ from country to country,” Van de Pavert points out. “Check out the rules and regulations in the destination country and tell your customers about your product specifications so that they will know exactly what you will be supplying and what requirements your products meet.”

Access2Markets is a database that contains every country’s product requirements and procedures. You can search the database with the HS code of your export products.

Video: Want to know the rules when exporting? Use Access2Markets

Market approach

You can go about exporting goods to new or existing export markets in several ways, such as by working with a middleman like a distributor or commercial agent, selling goods directly from a Dutch branch or by opening a foreign .

BrimaPack exports its machines in two ways. “Wherever possible, we sell packaging machines for small-scale growers through local distributors, who can deliver from stock and solve customer problems on site. Large growers buy field harvesters straight from us and we tailor them to their specifications. Larger growers often have their own technical department that can solve basic problems themselves and keep the machines running. If they run into an issue that they cannot solve, we catch a flight and fix it on site.”

Finding partners and customers

Taking part in trade fairs or going on trade missions is a good way to find customers and suppliers abroad. Van de Pavert occasionally goes to trade shows as an exhibitor, but he mainly relies on his own network to find new customers. “The world of vegetables is a small one. If you know that seed suppliers are selling seeds in a particular country, you can count on the fact that they will need packaging machines in the near future.”

Vetting your partners

Van de Pavert vets his customers before delivering any goods and always has a credit check done. “The average price of our packaging machines is €35,000 and large harvesters can command a price of up to €1 million. Before I accept an order, I always want to know whether my customer will be able to pay. On top of that, I go by my gut instincts.”

Arranging transportation

Agreeing on an Incoterm® tells both the supplier and customer exactly who is responsible for arranging transportation and who will bear the costs of damage during transportation. As standard, BrimaPack uses one Incoterm®. Although it is not mandatory, it is a sensible choice. “Most of our shipments are transported by sea. They go to Rotterdam on a flatbed trailer first, after which they are loaded onto a ship. We occasionally use air freight services, too, depending on the size of the machine and the destination, as shipping by air is usually too expensive. For our export shipments, we mainly use the Incoterm CIF haven Rotterdam, and sometimes Ex Works or DAP.”

A volcanic eruption in Iceland kept our shipment stuck for a full month

Insurance

To hedge its bets, BrimaPack also took out ongoing transport insurance. “But it helps to have luck on your side”, Van de Pavert adds with a smile. Competitors had told him that importing goods to Brazil could cost a lot of time and money. “So we sent our last shipment to Brazil by plane, because the customer was in a hurry. We offered the shipment under Incoterm® FCA Schiphol Airport, which meant that our customer assumed all risk and responsibility for the shipment from Schiphol on. We were incredibly lucky, because a volcano erupted in Iceland and kept our shipment stuck at Schiphol for a full month, followed by another month in Brazil.”

Export documents

To export goods to non-EU countries, you need export documents, including - at the very least - an export declaration, packing slip, invoice, and transport documents bij de zending. Which other documents you need, like an import licence or Certificate of Origin, depends on the product and destination country. To find out which documents you need to import goods, use the .

Van de Pavert adds: “Our forwarder tells us which documents we need. We do not have to send along special certificates or other documents for our machines, but we do occasionally use an invoice declaration for shipments to Switzerland so that our Swiss distributor pays less import duties.”

Customs and taxes

When you export products to non-EU countries, you have to submit an export declaration to Dutch customs, which you can only do if you have an EORI number, which is a required identification number. Once the shipment reaches the destination country, it will have to be cleared by customs based on the products’ HS codes. A product’s HS code determines its import duty class and whether additional import rules apply, such as import documents or a security check. The Incoterm® rule used determines whether the supplier or the customer is responsible for having the products cleared.

Van de Pavert outsources export declarations to a customs broker. “We have an in-house export officer who always works with the same customs broker, which helps cut a lot of red tape, such as buying and learning to use the digital declaration software.”

Import duties in the export country

For most products, either the recipient or the shipper has to pay import duties to customs in non-EU countries. Different products are subject to different import duty rates. For a comprehensive list of import duty and VAT rates by country, check out the database.

Van de Pavert explains: “Import duties are closely linked to a product’s HS code, but they are usually not our concern. Our customers always import the machines themselves and pay all duties due. Do make sure to find the best HS code for your product, as it can save your customer a lot of money in import duties.”

Export VAT

When you export goods to non-EU countries, you charge your customer the 0% VAT rate. If the tax authorities audit you, your records must show that the products in question left the EU. You can prove this with documents like the customs export document, transport documents and payment proof.

If you offer export shipments under the Incoterm® Ex Works, have your foreign customers sign a transport (in Dutch) when they pick up the goods to prove that the products left the EU. You need this proof in order to legally charge the 0% VAT rate.

Set your export price

The cost price of your product will include production costs, storage costs, insurance costs (in Dutch), transportation costs, and more. And that is before factoring in a profit margin.

BrimaPack does not have standard price lists and works mainly with bespoke quotations. “For each quote, we accurately work out the cost of materials, hours, and a profit markup, as well as passing on transportation and insurance costs. Besides, our customers also contribute to the time we put into product development, which is why we charge them for production hours and development hours.”

Record your agreements

Quotations usually sum up all the agreements made between suppliers and customers, and BrimaPack also attaches drawings, specifications, and other documents to their quotations, such as general terms of payment and delivery. The company uses the Metaalunie's standard terms and conditions.

Contracts with partners

If your customer accepts a quotation you have issued, it constitutes a valid agreement. You can also choose to lay down agreements in a contract, but Van de Pavert confesses that his company only occasionally works with official contracts. “Our quotations are rather comprehensive, to be honest. Customers do ask us to adjust our T&Cs every now and again, but we always seek legal advice before making any changes.”

Getting paid

Exporters want to make sure they get paid, preferably before they ship their products. The same goes for Van de Pavert. “We ask new customers to pay the lion’s share up front, which means that they will usually pay 90% of the full amount before we dispatch the machines. A typical payment schedule would be 30% upon submitting the order, 30% after two months of production, 30% prior to delivery and 10% within 14 days of receiving the machines.”

There is no standard form of payment for export shipments. Customers can either pay in advance or you can arrange payment with a Letter of Credit (L/C). Agreeing on a form of payment is part of the negotiation process. Banks provide useful information on the most suitable payment method for a particular transaction.